401(k) Retirement Umbrella Program

What is it?

The Leawood Chamber of Commerce 401(k) Retirement Umbrella Program uses a consolidated approach to shift fiduciary responsibilities specified by ERISA law and IRS and Department of Labor (DOL) regulations while striving to maintain compliance with applicable laws and regulations

A Cost-effective, turnkey retirement solution.

The Leawood Chamber of Commerce 401(k) Retirement Umbrella Program will help your small business spend more time running your business, not their retirement plan. The umbrella design handles administrative duties, reduces your risk and is cost-effective.

Advantages

Making it Simple

Employers don’t want to be 401(k) experts.

With a third party administrator, your business will be supported with plan setup, implementation, monitoring, enrollment, and other duties.

Compliance

Employers don’t want fines or penalties.

The plan uses processes developed to administer plans according to the Department of Labor (DOL) and IRS guidance to help avoid compliance issues.

Cost – effective

Employers don’t want to overpay.

The Leawood Chamber of Commerce 401(k) Retirement Umbrella Program is built on a pooled pricing model and may cost less than other programs offering fewer comprehensive services.

Fiduciary Protection

Employers don’t want to be at risk.

By shifting administrative, investment, and named fiduciary duties, employers can significantly reduce their legal obligations and responsibilities.

Customization

Employers want to choose.

The umbrella program allows employers to choose their plan design and investment line-up.

Well-known Providers

Employers want to work with industry leaders.

The Leawood Chamber of Commerce 401(k) Retirement Umbrella Program combines industry-leading professional service providers for “end-to-end” retirement plan oversight, including robust tools and resources for employees.

Administrative Responsibilities

The Leawood Chamber of Commerce 401(k) Retirement Umbrella Program removes more than 95% of your administrative tasks compared to sponsoring a plan on your own.

Your load is lighter with the Leawood Chamber of Commerce 401(k) Umbrella Program

As a retirement plan sponsor, your primary responsibilities are to select and monitor service providers and discharge fiduciary duties under ERISA:

- Upload payroll files

- Monitor the fiduciaries

Responsibilities without the Leawood Chamber of Commerce 401(k) Retirement Umbrella Program

- 3(38) Investment Manager Appointment, Monitoring and Removal

- 402(g) Limit Reporting

- 404(a)(5) Notice Distribution

- 408(b)(2) Notice Distribution

- Annual Discrimination & Coverage Testing

- Auto-Enrollment Notice Distribution

- Beneficiary Determinations

- Blackout Notice Distribution

- Census Review

- Corrective Distributions

- Death Benefit Approval

- Distribution Processing

- DOL and IRS Issue Resolution Assistance

- Eligibility Calculations

- Eligibility Notifications

- Error Correction Monitoring

- Force Out Processing

- Form 5330 Preparation & Filing

- Form 5500 Preparation, Signing, & Filing

- Form 8955 Preparation, Signing & Filing

- Fund Change Notice Distribution

- Hardship Withdrawal Approval

- Loan Approval & Reporting

- Loan Default Monitoring

- Loan Policy Administration

- Lost Earnings Calculations

- Participant Enrollment Assistance

- Payroll Aggregation

- Plan Design Review

- Plan Document Interpretation

- Plan Document Preparation & Archiving

- QDIA Notice Distribution

- QDRO Determinations & Reporting

- Required Minimum Distributions

- Safe Harbor Notice Distributions

- Summary Annual Report Productions & Distribution

- Summary of Material Modification Notice Distribution

- Summary Plan Description Production & Distribution

- Termination Date Verification & Maintenance

- Termination Withdrawal Approval

- Vesting Verification & Tracking

- Year-End Data Collection & Review

DOL audits can be costly for your business!

The IRS penalty for late filing of a 5500-series return is $250 per day, up to a maximum of $150,000. The DOL penalty for late filing can run up to $2,739 per day, with no maximum.

The Leawood Chamber of Commerce 401(k) Retirement Umbrella Program, will mitigate this risk for you and reduce cost provided that your business provides complete, accurate, and timely data to prepare and submit the Form 5500 filing on your behalf.

Over 20 years of experience

Experience over enthusiasm

Retirement plan providers are currently struggling to deal with pooled retirement plan solutions. Many are enthusiastically working with pooled plans, such as pooled employer plans (PEPs), since new regulations permitted an aggregated approach to save cost. Our team has been an innovator in pooled plan structures for more than 20 years. Our experience has helped employers understand how to structure the plan to get the best savings and protection available to you.

We have a proven track record of understanding employers’ needs and effectively meeting those needs.

Additionally, retirement plans carry significant fiduciary liability and government compliance exposure for employers. The Leawood Chamber of Commerce 401(k) Umbrella Program outsources the maximum allowable amount of fiduciary responsibilities and compliance. While most retirement plans do not offer this level of fiduciary and compliance assistance, the members of the Leawood Chamber of Commerce can benefit from discharging the investment fiduciary burden under ERISA 3(21) and ERISA 3(38) while discharging the administrative fiduciary burden under ERISA 3(16) and ERISA 402a.

Participant Experience

Driving participant success

The participant experience is designed to help people understand if their savings and investment strategy is in line with their retirement goals. It starts with enrollment and continues with personalized communications and financial education showing participants how they can improve their retirement readiness.

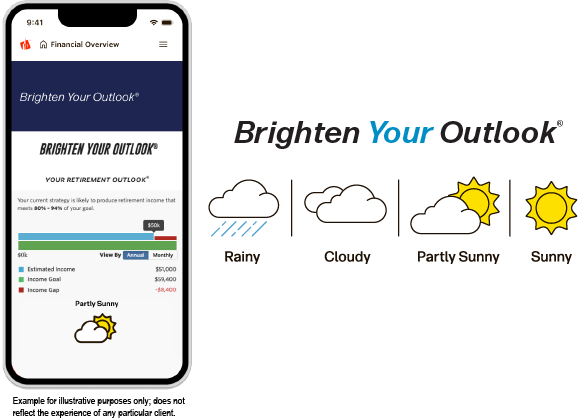

An easy-to-understand forecast is generated by the underlying methodology provided by Morningstar. Using simple weather icons, it shows participants if their current investment strategy is likely to produce the income they’re seeking in retirement and offers steps to improve their chances of achieving their goals. Your Retirement Outlook is featured prominently on the participant website, mobile app, and quarterly statements.

How long does it take?

Startup 401(k) Plan Timeline

Submit Application

Welcome & Plan Design Call

Account Setup via Census Upload

Distribute Mandatory Notices

Schedule Employee Meetings

Conduct Payroll Training

Conduct Employee Meetings

Remit Initial Contributions

Existing 401(k) Plan Timeline

Submit Application Paperwork

Welcome & Plan Design Call

Transfer Letter for Prior Plan Provider

Account Setup via Census Upload

Side-by-Side Comparison Call

Confirm Timeline of Transfer

Distribute Mandatory Notices

Conduct Employee Meetings

Conduct Payroll Training

Transfer Plan / Wire Assets

Remit Initial Contributions

Reconcile Plan Assets & Records

Blackout Ends & Plan Goes Live

Frequently Asked Questions

How flexible is the plan design if I join the Umbrella?

How flexible is the investment lineup if I join the Umbrella?

What if I already have an advisor, can I use my own Advisor and still join the Umbrella?

What’s the cost of the plan? How much does it cost to join the Umbrella?

What other questions do you have?

The 401(k) Retirement Umbrella Program Partners with

PHD. Retirement Consulting coordinates the Umbrella Program for the Leawood Chamber as a fiduciary to the entire program and as a fiduciary to each member company who joins the program. PHD. Retirement Consulting can serve as an advisor for the plans within the program as well as the plan participants within those plans. PHD. Retirement Consulting can also share that responsibility (and share revenue) with other financial advisors who are members of the Leawood Chamber of Commerce.